There is a long and distinguished list of academic contributors to a large body of literature which addresses the question—what makes capitalist democracies work better/best/optimally? Some of the preconditions established in that literature are: that taxes/subsidies address externalities (1); that property rights are respected, contracts are well understood and cheaply, honestly and easily enforced; and that ‘stewards’ (for example, elected politicians, trustees and company directors) seek to act in the genuine interests of their principals (respectively—voters, beneficiaries and shareholders).

This essay focusses on the last issue in the context of large listed public companies. It deals with the impact their operation has on the preconditions above—particularly the first and the third (2). That impact is twofold. Firstly, there is a direct impact; if, say, taxes inadequately incorporate environmental costs, corporate conduct may cause environmental damage. Secondly, there is an indirect impact which arises if companies are extended political rights; corporate political influence may seek to thwart good stewardship by elected politicians so as to ensure the profits flowing from that environmental damage are prolonged (3).

Following a glossary, the first section of this essay describes Anglophone corporate governance design and the functioning of Anglophone corporate democracy. It deals with the stewardship of directors, and, in particular, one important facet of influence over that stewardship—shareholder resolutions. The second section deals with corporate political influence. It contrasts arrangements in the US, the UK and Australia and, in this context, describes the use of shareholder resolutions—mandatory in the UK, commonplace in the US but virtually unknown in Australia. The conclusion contains a list of proposals to amend Australian law and the practice of public institutions to better support corporate democracy and to ensure rights of corporate political speech better support parliamentary democracy.

A. Glossary

Australasian Centre for Corporate Responsibility (ACCR) is an Australian not-for-profit which aims to further Australian corporate democracy (4)

Direct political expenditure refers to donations to, and other payments for the benefit of, politicians, parties, candidates, their associates or party/campaign support organisations and ‘own account’ expenditure (perhaps made independently of candidates or parties) but spent intending to influence public, bureaucratic or elite attitudes to candidates, parties or issues. It includes provision of ‘in-kind’ benefits.

ESG stands for Environmental, Social and Governance issues. They are issues of corporate conduct often not captured in a set of accounts. Motivations for understanding such issues vary. A shareholder might want to impose an ethical screen on their portfolio or want advice about how best to vote on at a company AGM or they might be concerned about the future price impact of government action which might, for example, price or regulate an environmental externality relevant to the company.

Indirect political expenditure refers to expenditure channelled through a third party, for example, a think tank, trade association, hired lobbyist or “astroturf” group to influence public, bureaucratic or elite support for politicians, candidates or parties or public, bureaucratic or elite attitudes to, or the outcome of, a political issue or an election (5).

Private ordering refers to social order that emerges without formal law.

Private Engagement refers to private, informal dialogue between investors and companies, with the aim of influencing their practices. Shareholder advocacy aka Active Ownership is private engagement plus filing and public support for resolutions with a view to improving returns and/or improving performance on ESG issues. Engagement is also sometimes used as an umbrella term covering private engagement plus voting on board initiated resolutions and the remuneration report plus filing/supporting shareholder resolutions.

Universal Owner is an investor with a highly diversified portfolio managed with a focus on long-term risk and return. Such portfolios are exposed to environmental and social costs caused by any one investee company which affect other investees. Universal owners don’t benefit when one company exploits an environmental or social externality at the expense of another company or manipulates the political system to the benefit of one company at the expense of another. Universal owners are also often described as institutional investors with large, passively managed portfolios. However, neither scale nor passive management is essential to the concept (6).

B. Anglophone corporate democracy and shareholder ESG resolutions

The corporate law of any one country has to address a number of basic questions.

Firstly, what do corporations owe society and the state in exchange for their right to exist? It is important to understand that corporations have no inherent right to exist—they are creatures of the state. The state bestows companies with the right of limited liability; listed public companies also get to raise monies from the general public. This is a substantial gift of rights from the state to private entites. What is the quid pro quo that should be expected in return? In Australia today, the current answer is—not much. But that is not a universal answer. Historically, in Australia companies had a ‘mission’ they had to stick to. In China today, shareholders have to accept a representative of the Communist Party will have a strong influence on corporate conduct. In the US, each state has a procedure to revoke the charter of a corporation that violates the law and it happens.

Secondly, how might corporate democracy work? Australian parliamentary democracy is primarily representative—elected politicians take decisions for all Australians (7).

Anglophone corporate democracy is also primarily representative. Mostly, shareholders elect directors and directors take decisions about the company. But it’s also participative, a lot more participative than Australian parliamentary democracy. In the UK shareholders can and do lodge and vote on both directive and advisory resolutions, in the US and Canada they are mostly advisory. In both cases, these practices are common. Until quite recently they have been unusual in Australia (8).

Thirdly, what political rights will be extended to corporations? Australia, the US and the UK have answered this design issue very differently. This issue is discussed further in section C below.

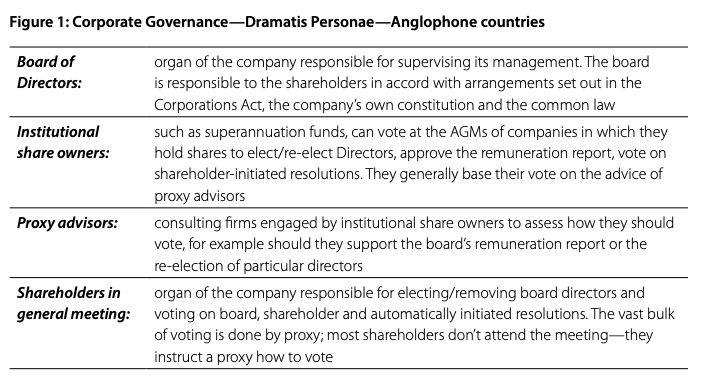

Figure 1 sets out some of the ‘players’ involved in the corporate governance of a listed company: shareholders, directors and proxy advisers. In aggregate, the shareholders’ relationship with a board is one of ‘principal’ and ‘agent’. Though the board has an overriding obligation to act in the interests of shareholders, the interests of the board will often diverge from those of shareholders. Shareholder resolutions are just one of the many ‘principal monitoring’ mechanisms commonly included in company law to check the extent to which the agent, in this case the board, can act in pursuit of its own interests rather than the interests of the principal, in this case the shareholders.

One group Australians are often unfamiliar with, who play an important role in the US and the UK, are those institutional shareholders who engage on ESG issues and sponsor ESG resolutions. They are most commonly church funds, specialist ethical or responsible fund managers or public sector pension funds (9).

Proxy advisers engaged by institutional shareholders form an attitude to all the resolutions and advise their clients how to vote.

The legal depiction above doesn’t illuminate the balance of power between the players, which varies across companies, countries and, importantly, time. Economic historians distinguish three stages of capitalism—entrepreneurial, managerial and fiduciary. Entrepreneurial capitalism is characterised by a situation where founding individuals or families dominate corporate activity. They held most of the shares. Managerial capitalism is characterised by a situation where managers are the central agents of corporate power. Fiduciary capitalism is characterised by a situation where ‘universal owners’ (10) (for example, super funds with broad portfolio holdings) exercise effective control over company boards and management. They ensure corporate focus reflects the long-term interests of the beneficiaries of the funds managed by the universal owners (11).

For many companies, Australia is in the slow process of change from managerial to fiduciary capitalism. This transition is happening in Australia for both domestic and international reasons. The international reason is that the transition is more advanced in the US and the UK and those countries are substantial sources of portfolio investment in Australia (12) so US and UK shareholders and their proxy advisers often bring a fiduciary capitalism perspective to their dealings with Australian investee companies. The domestic reason is the very large pool of superannuation assets and the slow but steady expansion of an expectation by Australian superannuation funds that Australian boards will focus on the long-term interests of the beneficiaries of those super funds.

The change has potential public policy advantages because shareholders, particularly those with a ‘universal owner’ perspective, have a strong long-term interest in ensuring their companies are good citizens. Governments can support or frustrate this transition. To date the Australian government has done little positive or negative in this regard.

Shareholder resolutions are a healthy part of corporate democracy in both the US and the UK and have been for many years (13). They allow shareholders (ie the principals) to express a view or direct the board (ie the steward) on an issue without escalating the dispute to a personality focus on re-election of particular directors. In the US similar or identical resolutions are often put many years in a row, slowly gaining support. In the first year a resolution needs to attract 3% of the vote to be put again. Support o faround 15–25% will generally result in the board agreeing to accommodate the proponent’s suggestions. Resolutions are put on an industrial scale over a vast range of subjects—child sex trafficking, climate change, political expenditure, gender pay equity, etc—every year. For every resolution actually considered at an AGM, a rule of thumb is that 2 to 3 will have been lodged but withdrawn following the company’s agreement to comply with the proponent’s suggestion. The following section focuses on one subject area—corporate political expenditure.

Corporate political expenditure (14)

This section deals with public and shareholder scrutiny and oversight of corporate political expenditure in Australia. Two classes of political expenditure are distinguished—‘direct’ and ‘indirect’. For definitions see the Glossary (15).

Donation practice in the UK at listed public companies changed significantly with the introduction in 2000 of law requiring majority shareholder consent by prior shareholder resolution to approve direct political expenditure. Many companies stopped making political donations (16). A study in 2015 found that 25 of the top 40 companies in the FTSE 100 had some ban on political contributions (17). The average donation ceiling for which approval was sought in the period 2001 to 2010 was £100k (18) but actual expenditure averaged only one eighth of that (19).

In the US, at the federal level, direct donations to political parties or candidates are banned and disclosure to shareholders of other direct political expenditure is commonplace.

Since the 2004 proxy season, shareholder resolutions seeking disclosure of political contributions and lobbying expenditure have been common in the US. For example, in 2014 there were 103 lodged with an average vote in support of around 20%. Seven received support in excess of 40% (20). The effort was initiated by the Center for Political Accountability, a non-partisan, non-profit advocacy organization (21). Many of the resolutions have been filed by the New York State Common Retirement Fund, (22). Since 2012, the breadth and quality of disclosure has improved. Voluntarily assumed ‘good corporate citizenship’ restrictions on political spending have significantly increased since 2004. The Center for Political Accountability has published since 2011 an annual survey scoring companies on an index which benchmarks companies on their political spending disclosure, decision-making and board oversight policies and practices. In 2015, 25% of companies covered by the index had some restriction on political spending. In 2004, few such restrictions were in effect (23).

Australian boards are free to spend company funds directly on political causes, should they so choose, substantially free of shareholder scrutiny let alone oversight (24).

Expenditure on federal level lobbying is subject to mandatory disclosure obligations in the US. In the UK it has become commonplace for companies to report in detail on their lobbying activities. By contrast, in Australia, there is no mandatory and minimal voluntary disclosure of lobbying expenditure.

In the US, as described above, companies are moving to disclose to shareholders (often as part of more general political expenditure disclosure) their payments to trade associations used for political purposes. By contrast, usage of trade associations is still an opaque area in the UK.

In Australia, three particular trade associations (25) have been used as channels for political expenditure by boards of ASX companies seeking to dissuade Australian governments from implementing policies to address climate change. Australia’s current ‘laggard’ status on climate change response reflects the success of these trade associations and this strategy. Disclosure by ASX companies of the quantum of, or rationale for, the use of shareholders’ funds for this purpose is virtually unknown.

In conclusion, in Australia, unlike in the UK and the US, for substantial sums of money across many companies it is impossible to tell the full amount of political expenditure or the extent to which the expenditure reflects the personal whim or short-term interests of boards or genuinely advances long-term shareholder interests. It is also impossible to tell how much these contributions actually influence Australian politics.

There have been a few recent attempts by shareholders to curtail misuse by boards of shareholders’ money for political purposes.

In early 2016, the ACCR identified NAB as a target for a resolution aimed at expenditure on political lobbying. NAB’s policy on political donations stated: “Our donations are not to express support for one side over another”. The Australian Electoral Commission’s (AEC) records showed that NAB paid $553,000 to Australian political parties in the three preceding financial years. Of this, three quarters went to the Liberal party and the remaining quarter to the ALP. NAB did not disclose any payments to smaller parties or independents. In the US, NAB’s conduct would have been illegal; in the UK it would have required shareholder approval. ACCR commenced the process of putting forward a resolution seeking a review of policy and practice for consideration at the NAB AGM. On 20 September 2016, NAB announced a new policy of not making any more political donations. ACCR welcomed the decision made by the NAB board and the resolution didn’t proceed.

In 2017 and 2018, ACCR lead-filed resolutions dealing with trade association membership at BHP and Rio Tinto (26). Both BHP and Rio had policies advocating the Australian government take constructive steps to respond to climate change. By contrast, these two companies were significant contributors to trade associations actively seeking to delay or obstruct climate change response in Australia. ACCR filed resolutions known in the US under the category-heading—‘board our company needs to stop walking both sides of the street’. The resolutions resulted attracted significant support (10% at BHP, 18% at Rio (27)) and significant change. For example, at BHP, the board agreed to conduct and publish a review of trade Association membership; the CEO of the Minerals Council of Australia resigned; and BHP exited the World Coal Association (28).

Conclusion

Capitalist democracies work better when taxes/subsidies address externalities, politicians seek to act in the best interests of electors and boards seek to act in the best interests of shareholders. Attention to the quality of our corporate democracy has been lacking in Australia and this inattention has compromised the functioning of our parliamentary democracy.

In the public policy context, I propose that:

- the Australian Corporations Act 2001 is reviewed to enhance shareholder primacy, to facilitate shareholder voting and to improve disclosure by asset owners of their voting record;

- in particular, the law is changed to facilitate shareholders putting both directive and advisory resolutions including resolutions which comment on the exercise of management function;

- Australian state and federal governments adopt a model asset owner (like a model litigant) approach to their own portfolio holdings, for example, through the Future Fund. At present, in general, disclosure of voting record by public authorities is worse than that by private sector entities (29);

- ASIC is resourced and required to enforce the current law in regard private sector voting record disclosure obligations. The current situation is that ASIC notes substantial non-compliance with the law but refrains from taking any action (30) There is little point having a regulator like this;

- the Commonwealth Electoral Act 1918 is amended to ban any direct payment by companies to parties or politicians;

- the Corporations Act is amended to ban any other political expenditure by a public company without an explicit authorising resolution of shareholders;

- tax deductibility for corporate lobbying expenditure is removed and all political expenditure by private companies is treated and taxed as a fringe benefit accruing to board members.

Note that there is nothing novel or unusual about any of these suggestions—each one of them reflects either or both US and UK law and practice.

Improved corporate democracy is no substitute for taxes and regulation which focus corporate decisionmakers on the externalities they benefit from/exploit. However, improved corporate democracy as it relates to corporate political expenditure has a highly leveraged public policy benefit because it enhances the chances taxes and regulation will reflect voter rather than short-term profit driven concerns about social and environmental issues.

End notes:

(1) The term externality is construed broadly in this essay. Failing to price a negative environmental externality like carbon emissions will result in too many emissions. Similarly, failing to price the negative social externalities caused by urban vehicle use will result in too much traffic congestion and too many car accidents. But, of course, not all citizens will exploit the common good and pricing and law aren’t the sole means of addressing externalities. In particular, companies will often have an interest in being seen as good corporate citizens.

(2) It doesn’t deal with asymmetry of legal resources and attempts to frustrate the legal process—for example, bribery and intimidation of the judiciary.

(3) Here is important to distinguish between benefit to shareholders and management. Firstly, the use of company funds for political purposes is, often, little more than a fringe benefit for directors and senior management justified by dubious claims it is of value to shareholders. Secondly, shareholders will generally be more concerned than senior management to ensure the company avoids a reputation for poor environmental performance.

(4) It seeks to improve Australian listed companies’ performance on environmental, social and governance (ESG) risk indicators. See https://accr.org.au/what-we-do/

(5) For those familiar with US political expenditure—Super PACs and c4s generally fall into this category though some c4s are more akin to Australian party associates.

(6) There is a large body of literature on the implications of Universal Ownership. For a guide, see UNEP Finance Initiative Universal Ownership Why environmental externalities matter to institutional investors 2011 at http://www.unepfi.org/fileadmin/documents/universal_ownership_ full.pdf

(7) But it’s also infrequently participative—we occasionally have referenda to change the constitution or advisory plebiscites like those used in WWI in regards conscription or the recent marriage equality survey.

(8) Primarily because the common law here has frustrated the statutory intent.

(9) For various cultural, legal and historical economic and financial reasons such groups never emerged in Australia the way they did in the UK and the US. They play an important initiating role in the process. They are often described as being ‘prepared to put their head above the parapet’ and risk antagonising powerful board, individual director and/or management interests in pursuit of long-term shareholder interests.

(10) Institutional investors with highly diversified and long-term portfolios. See Glossary.

(11) Robert Monks, co-founder of the proxy advisory business Institutional Shareholder Services (ISS), envisaged fiduciary capitalism would see shareholders become an “effective, informed, competent counter force to whom management must be accountable”. He envisaged much of what citizens might otherwise seek through the political process would be available to them as shareholders and that fiduciary capitalism would “restore ancient values of ownership that preceded the corporate form“. See p 145 of Bakan, J The Corporation: The Pathological Pursuit of Profit and Power, 2005 at http://new_words.enacademic.com/1278/fiduciary_capitalism

(12) Together, the UK and the US accounted for 53% of portfolio investment in Australia in equities as at end December 2017. See Table 13 ABS, International Investment Position, Australia: Supplementary Statistics 2017 at http://www.abs.gov.au/ausstats/abs@.nsf/mf/5352.0

(13) The text describes the situation in the US, for a reader interested in a comparative description of the UK see the reports available at https://accr.org.au/shareholder-resolutions/

(14) This section draws on the paper Corporate political expenditure in Australia, Howard Pender, 2016 see https://accr.org.au/politics/

(15) Together, indirect and direct expenditures are referred to as ‘political contributions’ or ‘political expenditure’.

(16) See Torres-Spelliscy, C & Fogel, K Shareholder—Authorised Corporate Political Spending in the United Kingdom, 2011 University of San Francisco Law review, v 46. p 558.

(17) Note though those bans don’t always apply to donations in any jurisdiction. See Transparency International http://www.transparency.org. uk/publications/corporate-political-engagement-index-2015/ p 3 and 12.

(18) See Torres-Spelliscy, C & Fogel, K ibid p 565.

(19) Ibid p 569.

(20) See http://corpgov.law.harvard.edu/2015/01/30/responding-to-corporate-political-disclosure-initiatives/

(21) The CPA is an independent organization that works closely with the Zicklin Center for Ethics Research at The Wharton School at the University of Pennsylvania

(22) Analogous to an Australian public sector super fund for State government employees.

(23) These developments are often depicted as a victory for private ordering. See, for example, Yablon, R Campaign Finance Reform without Law, University of Wisconsin Law School, 2017.

(24) Though there is some donation capping and mandatory disclosure of direct political donations, compared to other Commonwealth countries the regulation of political finance in Australia has been described as “laissez-faire, to the point of being lackadaisical”. See Orr, G The Law of Politics,2010 p 239.

(25) The Minerals Council of Australia (MCA), the Australian Petroleum Production and Exploration Association (APPEA) and the Australian Industry Greenhouse Network (AIGN).

(26) See https://accr.org.au/politics/bhp/ and https://accr.org.au/politics/rio/

(27) Note that because of the common law in Australia the resolutions were not formally put to the meeting, however they were included on the notice of meeting, all shareholders had the chance to instruct their proxy how to vote on the resolution, and the level of support had it formally been put to the meeting becomes known to shareholders. The vast bulk of votes on a resolution at an ASX listed company AGM are usually lodged before the meeting via proxy. ACCR’s co-filers for the Rio resolution were Australian Local Government Super, the Church of England Pensions Board and the Seventh Swedish National Pension Fund (AP7).

(28) For links to press coverage of this resolution see https://accr.org.au/politics/bhp/

(29) See Jones, R and Pender, H Survey of the responsible investment policies and related voting transparency of selected Australian asset owners and fund managers, 2018 at https://accr.org.au/wp-content/uploads/ACCR-RI-Survey-Report-2018.pdf especially p 10.

(30) Ibid p 3, see in particular fn 27.